Fixed Rates, Floating Rates, Variable Rates, Board Rates….Sibor, SOR, Combo, FHR and what not.

Here at SMP Consulting, our consultants constantly battles all these terms, trying to make sense of any promotions put up by the bank and analyzing which would be the best deal for our clients.

The big question here would be, what will it be like in 2015? Where is interest rate heading? Should I change now or wait till it gets higher?

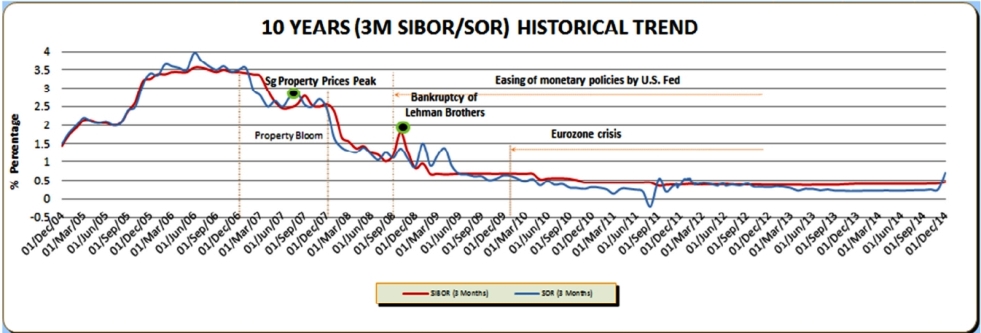

In order to see what is to come, we need to first look backwards at what has happened.

On a macro economics level, we’ve seen:

- From the stock market to jobs growth to GDP, the US economy has been improving slowly and steadily

- EU Zone is working it out except for the Russian rubble crisis that erupted recently.

- Right at home, Singapore is also chugging along.

Psst! These all means that we are no longer in the trough of a recession! Hooray!

However, before we starting clinking glasses and celebrating, these macro factors do have a domino effect on our interest rates. And we mean in in a way that may not be too beneficial to us.

Let’s now have a look at how interest rates locally have been behaving while the world was trying to get their acts right.

Here’s some definitions before we get started:

|

Sibor Rate |

Sor Rate |

Variable/Board Rate |

|

|

What is it |

SIBOR stands for Singapore Interbank Offered Rate.

It is a reference rate based on the interest rates at which banks offer to lend unsecured funds to other banks in the Singapore wholesale money market (or interbank market) |

SOR stands for Singapore Swap Offer Rate.

It is the expected forward exchange rate between the US dollar and Singapore dollar. It is linked to currency movements, and thus is more volatile than SIBOR. |

Variable rates are based on individual banks’ Board Rates.

These rates are determined by the banks based on their internal cost as well as market rates It is a type of floating rate as well |

|

Who sets it |

By the Association of Banks in Singapore (ABS) |

By the Association of Banks in Singapore (ABS) |

Determined by banks |

|

Where can we track it |

Newspaper, Online etc |

Newspaper, Online etc |

Have to check with the banks

|

Since the start of the financial crisis, we’ve seen interest rates remaining low amidst the property boom in Singapore. Sibor has been at its lowest around 0.5% while SOR has been around 0.2%.

In 2014, we’ve seen banks steadily increasing their spreads (see previous article) perhaps to increase their profit and also the fixed rates as shown below.

|

The average of the 1st 3 years rates offered by banks in 2013 (using the most competitive loan package):

|

The average of the 1st 3 years rates offered by banks in 2014 (using the most competitive loan package): |

||

|

Fixed |

1.31% |

Fixed |

1.41% |

|

Sibor |

3mth Sibor + 0.7% |

Sibor |

3mth Sibor + 0.85% |

|

Sor |

3M SOR + 0.7% |

Sor |

3M SOR + 0.85% |

|

Variable Board |

1.48% |

Variable |

1.48% |

Fixed rates are a good indicator of what the bank’s expectations on future rates could be.

As such, we do believe that interest rates are on a rising trend, and this uptrend could be here to stay for a while, similar to how it was after the 2000s dot com bubble’s recovery. At the same time, though US Fed President Ms. Janet Yellen have recently mentioned that interest rates will be slow to rise, markets are pricing in rates to be increasing from mid 2015 onwards.

Here at home, we’ve been seeing banks’ promotional fixed rates increasing by 0.1% on average every quarter. As such, you may seen in the local news about clients opting for fixed rates.

Our statistics shows that, 1 in 4 of our customers opted to change to fixed rates for a few sound reasons.

1. They have experienced high interest rates previously and are smart enough to lock in the low rates for as long as they can

2. To have a peace of mind and not worry about any rate increase

3. Floating rates have typically been lower but fixed rates are just as low right now. It’s a bargain hunter’s paradise

How about floating rates? The 3-month SIBOR (Singapore interbank offer rate) is expected to rise from last Thursday's 0.45 per cent to a median forecast of 0.64 per cent by Q3 next year and 0.81 per cent by Q4 2015, according to Bloomberg.

As for SOR, we have seen 3 mth SOR rate increasing from 0.22% in Sep to a whopping 0.7% in the past few days. How crazy is that!? For those of you with a SOR loan package, please do take note!

As we approach the last day for the year, perhaps this is a good time to take out your statements and check if you will be hit by the increase in rates next year. Need some advice on what to do next or how to protect yourself from the sudden increase in rates? Do check in with us, and let us know how we can help.

Cheers!