Just a shout out:

If you’ve not heard it from EVERYWHERE yet, interest rates spiked recently! (Yes, there’s been some initial panic in the market)

3mth Sibor for example has moved up 49% since Dec to 0.64%. There’s been a flurry of activities these few weeks as banks have quickly reacted to the increase, moving to their promotional rates.

If you are on sibor packages, do check in with us as you may well be paying 2% or more starting this month.

Fixed Rates, Floating Rates, Variable Rates, Board Rates….Sibor, SOR, Combo, FHR and what not.

Here at SMP Consulting, our consultants constantly battles all these terms, trying to make sense of any promotions put up by the bank and analyzing which would be the best deal for our clients.

The big question here would be, what will it be like in 2015? Where is interest rate heading? Should I change now or wait till it gets higher?

In order to see what is to come, we need to first look backwards at what has happened.

On a macro economics level, we’ve seen:

- From the stock market to jobs growth to GDP, the US economy has been improving slowly and steadily

- EU Zone is working it out except for the Russian rubble crisis that erupted recently.

- Right at home, Singapore is also chugging along.

Psst! These all means that we are no longer in the trough of a recession! Hooray!

However, before we starting clinking glasses and celebrating, these macro factors do have a domino effect on our interest rates. And we mean in in a way that may not be too beneficial to us.

Let’s now have a look at how interest rates locally have been behaving while the world was trying to get their acts right.

Here’s some definitions before we get started:

|

Sibor Rate |

Sor Rate |

Variable/Board Rate |

|

|

What is it |

SIBOR stands for Singapore Interbank Offered Rate.

It is a reference rate based on the interest rates at which banks offer to lend unsecured funds to other banks in the Singapore wholesale money market (or interbank market) |

SOR stands for Singapore Swap Offer Rate.

It is the expected forward exchange rate between the US dollar and Singapore dollar. It is linked to currency movements, and thus is more volatile than SIBOR. |

Variable rates are based on individual banks’ Board Rates.

These rates are determined by the banks based on their internal cost as well as market rates It is a type of floating rate as well |

|

Who sets it |

By the Association of Banks in Singapore (ABS) |

By the Association of Banks in Singapore (ABS) |

Determined by banks |

|

Where can we track it |

Newspaper, Online etc |

Newspaper, Online etc |

Have to check with the banks

|

Since the start of the financial crisis, we’ve seen interest rates remaining low amidst the property boom in Singapore. Sibor has been at its lowest around 0.5% while SOR has been around 0.2%.

In 2014, we’ve seen banks steadily increasing their spreads (see previous article) perhaps to increase their profit and also the fixed rates as shown below.

|

The average of the 1st 3 years rates offered by banks in 2013 (using the most competitive loan package):

|

The average of the 1st 3 years rates offered by banks in 2014 (using the most competitive loan package): |

||

|

Fixed |

1.31% |

Fixed |

1.41% |

|

Sibor |

3mth Sibor + 0.7% |

Sibor |

3mth Sibor + 0.85% |

|

Sor |

3M SOR + 0.7% |

Sor |

3M SOR + 0.85% |

|

Variable Board |

1.48% |

Variable |

1.48% |

Fixed rates are a good indicator of what the bank’s expectations on future rates could be.

As such, we do believe that interest rates are on a rising trend, and this uptrend could be here to stay for a while, similar to how it was after the 2000s dot com bubble’s recovery. At the same time, though US Fed President Ms. Janet Yellen have recently mentioned that interest rates will be slow to rise, markets are pricing in rates to be increasing from mid 2015 onwards.

Here at home, we’ve been seeing banks’ promotional fixed rates increasing by 0.1% on average every quarter. As such, you may seen in the local news about clients opting for fixed rates.

Our statistics shows that, 1 in 4 of our customers opted to change to fixed rates for a few sound reasons.

1. They have experienced high interest rates previously and are smart enough to lock in the low rates for as long as they can

2. To have a peace of mind and not worry about any rate increase

3. Floating rates have typically been lower but fixed rates are just as low right now. It’s a bargain hunter’s paradise

How about floating rates? The 3-month SIBOR (Singapore interbank offer rate) is expected to rise from last Thursday's 0.45 per cent to a median forecast of 0.64 per cent by Q3 next year and 0.81 per cent by Q4 2015, according to Bloomberg.

As for SOR, we have seen 3 mth SOR rate increasing from 0.22% in Sep to a whopping 0.7% in the past few days. How crazy is that!? For those of you with a SOR loan package, please do take note!

As we approach the last day for the year, perhaps this is a good time to take out your statements and check if you will be hit by the increase in rates next year. Need some advice on what to do next or how to protect yourself from the sudden increase in rates? Do check in with us, and let us know how we can help.

Cheers!

Season’s greetings to all our readers! Hope you are having a restful and joyful time with your family and friends.

I’m sure you feel the same way as we do about the pace in Singapore. Fast, faster and even faster if possible.

The year flew by so quickly and before we knew it, we are hitting the end of 2014! That also reminded us that we have not been updating as frequently in this space as we would like. Many apologies for that!

It’s been an exciting second half of the year, and we are taking this opportunity to share with you what’s been going on in the mortgage scene aka gladiator arena. Yes, it’s been brutal.

- Many Foreign banks started removing fixed interest rates, and we highly suspect that they are unable to commit to these rates, predicting that rates will be on an uptrend in the coming years.

- Spreads (which is what the bank earns) for floating rates have been steadily increasing. We know banks have been seeing red with the tight earnings from low loan interests. The slowdown in the property market is a double whammy for them and the only way to keep business afloat is to increase their margins.

- There banks have been changing the packages quite often in the past quarter to better adjust to the market’s supply and demand. What this means to us who are trying to refinance or obtain new loan is that the bank keeps flipping like the prata being cooked, and EVERY promotion can be stopped or changed anytime.

- TDSR is a deadly disease that has striked many people who needs a new loan/to refinance their loans badly. Those who have issues and are facing an increase in interest rates, needs to restructure their loan but cant, as their income/age do not meet the regulated criteria. (so they say, the poor gets poorer). We get close to 40% loan application rejection rate these days which is pretty high. We think it would get worse when more credit issues surfaces and the regulation continues to be inflexible towards people who really need help.

- Banks have also become selective in the properties they are willing to take in as collateral. Hence, not every property can get a new loan or refinanced.

With all these situations on hand, we’ve thus been busy finding solutions and working closely with the banks to find out how these issues can be addressed.

There are many factors involved and each situation is different. What we can do is to try our best to advise each client ways to overcome such issues and minimize their housing loan interest and debt through our experiences.

If you are wondering if you would be encountering any of the abovementioned situations, and worried about what your next interest rate will be for your loan, or even be in the midst of the above-mentioned problems, do drop us a note, and we will be happy to have a chat with you. Just remember to throw in a cup of coffee if we do get to help. =)

After much complains and feedbacks being made, MAS had finally decided on 10th Feb 2014, to update the Total Debt Servicing Ratio (TDSR) measuresimplemented last year.

Earlier, in a bid to curb individuals from over-borrowing for their properties, the TDSR was implemented to ‘right size’ the loans and ‘reduce vulnerability to adverse economic conditions or changes in interest rates’.

This rule has however hurt many investors and older folks who have over leveraged previously, received lower income in the recent years, and/or due to increasing age, face a shorter loan tenor which equals to high monthly installments for the mortgage, and also a TDSR percentage too high to even mention it here.

The revised rules, in a nutshell, allow home-owners to be able to refinance their mortgage even if their TDSR has exceeded 60%. Well that’s if they meet certain requirements (as usual!):

- The property has to be occupied by the owner him/herself and is not rented out for investment purposes

- You would have bought this property before 29th June 2013 (before TDSR was introduced)

- You do not own any other property or have other property loans (the second part refers to the guarantors out there for some property loans)

For HDB & EC owners restricted by the Mortgage Servicing Ratio (MSR), it will also not apply if you have bought the flats before 12 January 2013 for HDB flats and 10 December 2013 for ECs purchased directly from a property developer.

As for investment property owners, not to worry as you are not left out entirely. You can still refinance your loans even if your TDSR has exceeded 60% provided:

- You would have bought this property before 29th June 2013

- You and all the borrowers agrees to a debt reduction plan offered by the bank when refinancing

- You and all the borrowers pass the bank’s credit assessments

*The deadline is however 30th Jun 2017.

As of today, only a handful of banks have embraced these new measures and are still in the process of fine-tuning their assessment process, while the rest are still working on TDSR<60% as a benchmark to make any new loan/refinancing offers.

For the very few banks that are efficient enough to give it a go, the following can be proposed to the banks for refinancing:

- In line with MAS’s rules on a ‘debt-reduction plan’, borrowers could pay off a certain % of their outstanding loan, and the bank will undertake the balance loan even if TDSR > 60%

- Another option offered was for a certain % of their outstanding loan to be repaid over a short loan tenure while refinancing the balance loan on the usual loan tenure allowable.

- You have tons of cash and/or liquid investments lying around to justify that you can bury the bank with your money even after paying off your loans and other debts.

All these options weigh heavily on your credit bureau record which should be in flying colors (all As). This means no late payments for your credit cards and other loans. You should also preferably have good fixed pay income with regular CPF contribution or high variable income declared on your Notice of Assessment (NOA).

Should you require some help in figuring out if you meet the TDSR requirements or running out of options banks to refinance your mortgage due to previous over leveraging, please do check with our experienced mortgage brokers on the exemption details offered by the banks.

Perhaps it’s time to cancel and cut up those credit cards lying unused in the drawers, and ninja past the next credit card promoter who waives a free gift in your face when you walk by them.

The Gods of HDB have spoken once again. If you have not heard it, there’s a new game in town for buying and selling your beloved HDB flats.

With effect from 10th Mar 2014 at 5pm SG time, HDB will only accept valuation requests from resale flat buyers (or their appointed salesperson), after the buyers have been granted an Option to Purchase (OTP) by flat sellers. This is put in place to ‘reduce the focus on Cash-Over-Valuation (COV), and allow the negotiation base on recent transaction prices’ that HDB will publish daily. Other changes include a 21 calendar days option period instead of the previous 14 day period.

For those who are IN the process of buying/selling your flats already, our government have allowed HDB to accept the OTPs and valuation reports granted before yesterday and have not expired.

But what about those of us who still want to buy our first flat or upgrade to a bigger HDB flat? What does it mean for us? What are the pros and cons?

- Option Fees may go lower than the typical amount of $1000. More negotiation will be done on this, and sellers may not agree to lower commitment amount, as they may find it a waste of time.

- Buyers will now be even more selective since it’s money-down-first situation.

This should tip the scales in favor towards buyers whom we are expecting to have more bargaining power as sellers scramble to let go of their flats. - Since price has to be agreed upon first, it makes sense to pay only for a conservative estimate, close to today’s last transacted price.

Should valuation turns out to be lower than agreed price, that would mean more money flying out of your pocket in the form of COV as loans are based on the lower of purchased price or valuation. Not good for that new car you had in mind.

Should the valuation be higher, shout hooray and pop champagne! You’ve got a great bargain! (This can normally be achieved if you can spot a well renovated property that seems undervalued).

Overall, a good move by our government that supports buyers. The downside however is the guess work involved, and thus more sleepless nights while waiting for the valuation report to be ready.

Instead of sweating over the agreed purchase price, we would suggest buyers to

- Keep track of latest HDB transacted prices to be informed

- Understand the flats intrinsic value to you -> I like it as it’s near my son’s school, just downstairs!

- Must Must Must do an Approval In Principle (AIP) to determine the maximum amount of loan you can obtain from HDB/bank. Without it, you are akin to driving blindfolded on the MCE!

Want to know exactly how much you can loan and the monthly repayments? Contact us now to do an Affordability Analysis. We’ll be happy to help you out of this maze!

With headlines on HDB’s Cash-over-valuation (COV) crashing through the roof and private home sales crawling like snails, the murmurings of a possible increase in mortgage interest rates have started to surface in the neighborhood coffee shops.

Is it time to be concerned about hiking rates? You bet it is!

Taking an average loan size of $500,000 over a loan period of 20 years, a jump in interest rate from a comfy 1% to 2.5% would mean forking out at least an extra $350 from your pocket every month. That’s $4200 a year or 4 trips to Bangkok, or 3 trips to Hong Kong or 2 trips to Bali….ok you get the point. Extra money given to the bank and none for yourself. Zilch!

But hey, that’s not fair you say! Sure it’s not! How did that happen? Or rather WILL it happen to me?

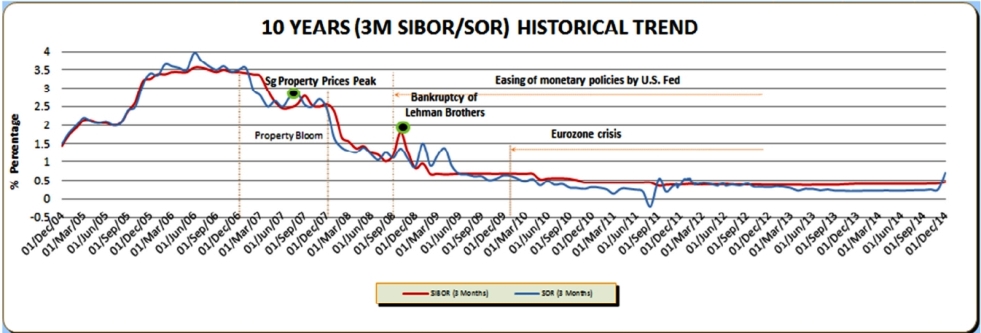

Let’s look at what the situation has been with our interest rates in the past few years during the Global Financial Crisis (GFC) starting in 2007.

With the falling out of banks and governments rushing to bail them out, Singapore’s Interbank Offer Rate (SIBOR), and Swop Offer Rate (SOR) started declining following the US Federal Reserve’s moves to cut rates in the US to save and kickstart the US economy. Starting in 2010, Sibor and SOR rates begin to plateau, hovering at an average of 0.5% in subsequent years. SOR even managed to dip lower to below 0% in late 2011! For those of you who have bought your dream condo then, your interest rate would have been incredibly low at about 1% or less.

That explains why you’ve been throwing the bank statements aside after seeing how measly low the monthly installment was, until it shot up recently if you’ve been on a board rate loan package.

We then witness the lowest interest rates in 2012 to mid-2013 at 0.38% for 3mths Sibor. Since then, the rates have been creeping back up to 0.4% and higher till date.

Would you like to find out if you are overpaying on your mortgage? Do contact us, for a non-obligatory review of your loan portfolio.

Will interest rates start skyrocketing or dip back into the drains in the next few years?

Stay tune as we continue our analysis in the next article on what may possibly happen ….

What happened when the TDSR is coupled with rising housing interest rates?

With the introduction of Total Debt Servicing Ratio (TDSR) framework by Monetary Authority of Singapore (MAS) mid last year, the local property market has cooled off significantly. Though it was not officially considered as the 8th government’s property cooling measure, it was probably the most effective measures till date on cooling the red hot local property market. Prior to the implementation of TDSR framework, though every bank already has a set of loan approving criteria, their practices may not be even across the industry. So there are group of borrowers who had previously taken the mortgage loan before the new framework was introduced, they may not have qualified for the same housing loan now with the current TDSR framework. As the current interest rates are still low, it did not warrant any concern for this group of borrowers, but with the impending rising interest rates in the foreseeable future, the same group of borrowers may be greatly affected if they are not able to restructure their loan to a better interest package when necessary.

The thing to avoid is when you are due for refinancing, or you want to lower your loan interest package, then you find out that you are not able to get the bank to refinance or re-price your mortgage. Let’s look at who may falls into the risky group:

- Borrowers who relied on guarantor(s) for their existing loan. You may be stuck with this current arrangement as the borrower now will have to be the mortgagor of the property. Similarly, for those who have borrower who are non-mortgagor for their existing loan. But as of now, there are a couple of banks that may allow the refinancing of such loans with the same loan structure.

- Borrowers who have previously relied on asset based methods or priority banking relationships to secure their loans.

- Elderly parents who have helped or used their kids (especially those who just started working) to buy a private property.

- Borrowers who bought a car with high instalment plan or taken many credit facilities.

- Multiple Property Owners who may be hit by lower rental income, no tenant or rental tenancies which are expiring soon at the point of refinancing. A higher housing loan interests in the future imposed on your entire properties portfolio may also means your TDSR score may fall.

- Loss of job or in between jobs at the point when refinancing is due. Notwithstanding retrenching, it may be worth taking note of the timing of the two events before any decision making.

A little note that borrowers who chose to opt for very short loan tenure may find the high instalment for this particular mortgage affecting his other property purchase.

The key point to note is even for refinancing and re-pricing, TDSR will be applicable as well. So it is timely for these risky groups to work out their financials early and to make necessary changes before they are caught in a situation where they cannot refinance or re-price to a better loan rates and have to pay high housing loan interest. The idea is to avoid pressing the panic button later on.

A stress test on your TDSR score may be good to determine if you fall in any of the mentioned risky group.

Though according to the MAS guidelines, there may be those who may be exempted from TDSR if they meet certain conditions (MAS’ Guidelines on the Application of TDSR for Property Loans under MAS Notices 645, 1115, 831 and 128). It is not to be taken for granted that the banks will approve their refinancing even if these conditions are met. As it is now, there are banks which simply relied on the 60% TDSR to approve or decline the loan.